During 2016,Marsha,an employee of G&H CPA firm,drove her car 24,000 miles.The detail of the mileage is as follows:

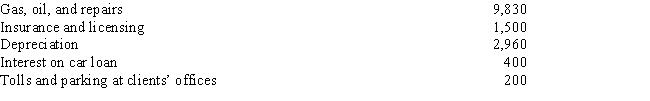

Marsha's 2016 records show that her car expenses totaled $14,320.The details of the expenses are as follows:

What is the amount of her deduction for her use of the car?

A) $9,000

B) $9,920

C) $10,490

D) $10,640

E) $10,790

Correct Answer:

Verified

Q33: Lester uses his personal automobile in his

Q34: Penny owns her own business and drives

Q34: Ernest went to Boston to negotiate several

Q35: Which of the following business expenses is/are

Q36: Mercedes is an employee of MWH company

Q37: Walker,an employee of Lakeview Corporation,drives his automobile

Q40: Donna is an audit supervisor with the

Q42: Safina,a single taxpayer with adjusted gross income

Q43: George is a full-time student at Indiana

Q43: During 2016,Wan-Ying,a lawyer,made a bona fide $5,750

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents