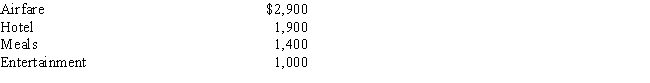

Mathew works for Levitz Mortgage Company.The company has an accountable reimbursement plan.During the year Levitz reimburses Mathew $5,400 for his business expenses.Mathew's adjusted gross income for the year is $45,000.His business expenses are as follows:

What amount will Mathew be able to deduct as a miscellaneous itemized deduction?

A) $- 0 -

B) $600

C) $1,200

D) $1,500

E) $1,800

Correct Answer:

Verified

Q84: Charlie is single and operates his barber

Q84: Brees Co.requires its employees to adequately account

Q86: Brenda travels to Cleveland on business for

Q87: Oliver owns Wifit,an unincorporated sports store.In 2017,Wifit

Q91: Joline works as a sales manager for

Q92: Chi is single and an employee of

Q93: Richard is a sales person for Publix

Q95: Kyle is married and a self-employed landscaper.

Q98: Lynn is a sales representative for Textbook

Q100: Ester is a sales representative for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents