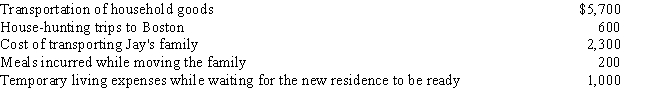

Jay obtains a new job in Boston and moves from Reno during the current year.He incurs the following moving expenses:

What is Jay's moving expense deduction?

A) $- 0 -

B) $5,700

C) $8,000

D) $9,700

E) $9,800

Correct Answer:

Verified

Q121: Which of the following is (are)correct concerning

Q123: Match each statement with the correct term

Q128: Match each statement with the correct term

Q129: For each of the following situations, determine

Q129: Martha is single and graduated from Ivy

Q130: Thomas changes jobs during the year and

Q131: Carla changes jobs during the year and

Q134: Roscoe is a religion professor. During the

Q139: Match each statement with the correct term

Q140: Match each statement with the correct term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents