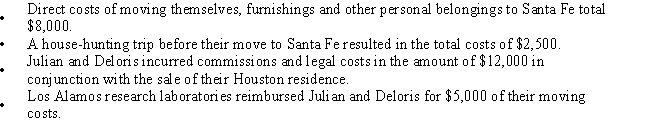

Julian and Deloris move during the current year from their home in Houston to Santa Fe.Julian was a rocket scientist with NASA in Houston and has accepted a new job with the Los Alamos research lab near Santa Fe.Moving expenses and reimbursement information are presented below.

What is their Moving Expense deduction?

A) $17,500 deduction from AGI.

B) $8,000 deduction for AGI.

C) $10,500 deduction from AGI.

D) $3,000 deduction for AGI.

E) $22,500 decution from AGI.

Correct Answer:

Verified

Q122: Match each statement with the correct term

Q125: Jerry recently graduates with an MBA degree

Q126: Match each statement with the correct term

Q127: For each of the following situations explain

Q130: Thomas changes jobs during the year and

Q131: Carla changes jobs during the year and

Q131: Phong is a life insurance salesman for

Q132: Match each statement with the correct term

Q133: Match each statement with the correct term

Q135: For each of the following situations

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents