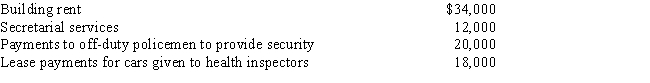

Chelsea operates an illegal gambling enterprise out of her restaurant.Considering only the following expenses,what amount can Chelsea deduct?

A) $- 0 -

B) $46,000

C) $66,000

D) $72,000

E) $84,000

Correct Answer:

Verified

Q64: Which of the following expenses is/are deductible?

I.Transportation

Q69: Which of the following expenditures or losses

Q71: Michael operates an illegal cock fighting business.

Q75: Which of the following factors are used

Q77: Which of the following production of income

Q80: Jennifer pays the following expenses for her

Q81: James rents his vacation home for 30

Q82: Michelle is a bank president and a

Q83: Landis is a single taxpayer with an

Q84: Mike and Pam own a cabin near

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents