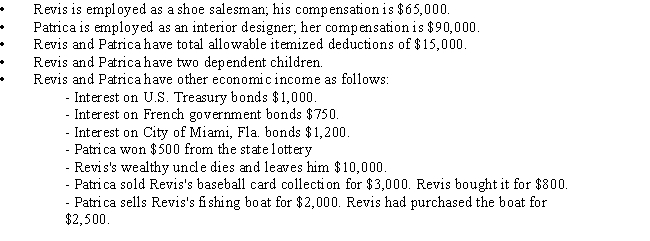

The information that follows applies to the current year for Revis and Patrica,a married couple.

Based on the above information,what is Revis and Patrica 's taxable income?

A) $126,150

B) $129,950

C) $128,250

D) $144,450

E) $159,450

Correct Answer:

Verified

Q82: Discharges of debt are generally taxable. However,

Q92: Dean is a singer. After a singing

Q93: Mavis is injured in an automobile accident

Q95: Norma is in the 33% marginal tax

Q98: Harry owed $10,000 to his employer. The

Q102: Jolie purchased her residence in 2011 for

Q103: Joan purchased her residence in 2011 for

Q104: Bob and Linda purchased their vacation home

Q114: Which of the following statements is/are correct?

I.Belle

Q115: Match each statement with the correct term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents