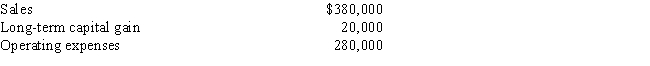

Amanda,who is single,owns 40% of the Sherwood Partnership.During the current year,Sherwood has the following results:

a.Amanda withdraws $15,000 from the partnership.In addition,Amanda has a $30,000 long-term capital loss from the sale of an investment.What is Amanda's gross income from this information? Explain and show your calculations.

b.Assume that in the next year,Sherwood Publishing has $80,000 of ordinary income,Amanda has a $24,000 short-term capital gain and taxable income from other sources of $20,000.What is her adjusted gross income? Explain and show your calculations.

Correct Answer:

Verified

Q123: Victoria is an employee of The Bellamy

Q124: Twenty years ago Pricilla purchased an annuity

Q140: On December 24 of the current year,

Q143: On January 1 of the current year,

Q144: Barrett is a real estate broker.He actively

Q146: In 2005,the Force Partnership purchased an apartment

Q148: Arnold is the President of Conrad Corporation.Arnold

Q149: Stephanie and Matt are married with 2

Q152: Cathy,an attorney,bills a client $12,000 for services

Q154: Sarah is single and retires in 2017.During

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents