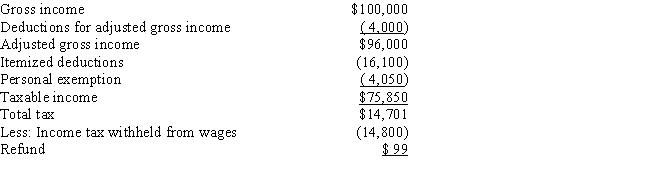

Sally is a single individual.In 2016,she receives $10,000 of tax-exempt income in addition to her salary and other investment income of $100,000.Sally's 2016 tax return showed the following information:

Which of the following statements concerning Sally's tax rates is (are) correct?

I.Sally's average tax rate is 19.4%.

II.Sally's average tax rate is 25.0%.

III.Sally's marginal tax rate is 25%.

IV.Sally's marginal tax rate is 28%.

A) Statements I and III are correct.

B) Statements I and IV are correct.

C) Statements II and III are correct.

D) Statements II and IV are correct.

E) Only statement IV is correct.

Correct Answer:

Verified

Q44: Lee's 2017 taxable income is $88,000 before

Q45: The mythical country of Woodland imposes two

Q46: Betty is a single individual.In 2017,she receives

Q47: Alan is a single taxpayer with a

Q48: Elrod is an employee of Gomez Inc.During

Q51: Jered and Samantha are married.Their 2017 taxable

Q53: Employment taxes are

A)revenue neutral.

B)regressive.

C)value-added.

D)progressive.

E)proportional.

Q54: A tax provision has been discussed that

Q54: The mythical country of Traviola imposes a

Q58: Taxpayer A pays tax of $3,300 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents