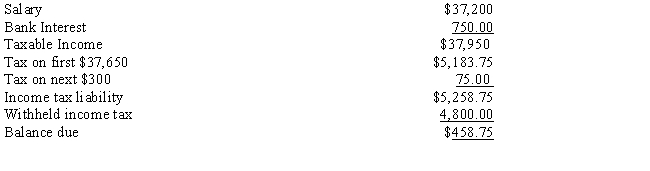

Barry has prepared the following 2017 income tax estimate for his sister,Sylvia.Sylvia is single,age 32,and has no children.Sylvia is an employee of General Motors and rents an apartment.Her only investment is a savings bank account.

Identify the errors,if any,in Barry's income tax estimate.

Additional calculations are not required.

Correct Answer:

Verified

Q102: Match each term with the correct statement

Q108: Match each term with the correct statement

Q114: Match each term with the correct statement

Q118: The Statements on Standards for Tax Services

Q123: Harriet and Harry are married and have

Q123: Match each term with the correct statement

Q125: Match each term with the correct statement

Q127: Match each term with the correct statement

Q127: On December 28,2017,Doris and Dan are considering

Q133: Match each term with the correct statement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents