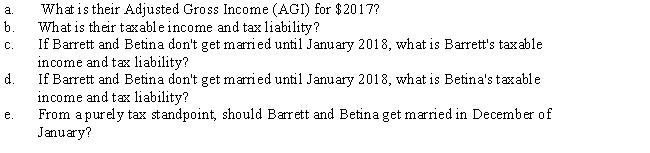

Barrett and Betina are planning to be married on December 26,2017.Barrett's salary for 2017 is $42,000 and Betina's is $40,000.Barrett pays mortgage interest of $7,200 and property taxes of $1,800;Betina has $400 of charitable contributions.Barrett earns interest of $1,450 on a savings account and makes a deductible for AGI contribution to his IRA of $2,000.Betina makes a $1,000 deductible contribution to her IRA.Amounts withheld for State taxes are $1,900 for Barrett and $1,800 for Betina.Based on the above information,answer the following questions to help Barrett and Betina prepare their 2017 tax return (they will file jointly and have no other dependents):

Correct Answer:

Verified

Q128: Raquel is a recent law school graduate.

Q130: Match each term with the correct statement

Q140: Match each term with the correct statement

Q141: Amy hired Carey,a CPA,to prepare her 2017

Q142: Pedro,a cash basis taxpayer,would like to sell

Q143: Monty is a licensed Certified Public Accountant.

Q144: In December 2017,Arnold is considering one last

Q145: Madeline operates a janitorial service. The business

Q147: Ed travels from one construction site to

Q148: Rosemary is single and works for Big

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents