Frannie's Dance Studio accounting records reflect the following account balances at January 1, 2017.

During 2017, the following transactions occurred:

1. On February 1, rented a small studio for one year. Paid $6,000 cash.

2. On November 1, received $1,200 cash for dance lessons to be provided evenly over November, December, and January.

3. By December 31, used $3,000 of the supplies

4. At December 31, accrued $3,000 in wages and salaries.

5. During the year, paid $20,000 in cash for wages and salaries.

6. During the year, earned $40,000 cash in dance lesson revenue.

Required

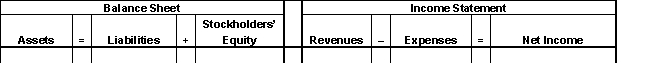

A. Determine the effect on the accounting equation of the preceding transactions. Create a table to reflect the increases and decreases in accounts.

B. Prepare an income statement for Frannie's Dance Studio for 2017. Ignore income tax effects.

B. Prepare an income statement for Frannie's Dance Studio for 2017. Ignore income tax effects.

C. Prepare a classified balance sheet for Frannie's Dance Studio at December 31,2017.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q193: Scenic View Foods Corporation

The following consolidated statements

Q194: Malco Tile Shop purchased insurance coverage

Q195: Scenic View Foods Corporation

The following consolidated statements

Q196: Motor Repair Shop uses the accrual

Q197: Calzone,Inc.signs a 9%,four-month,$50,000 loan with Reliable Bank

Q199: Motor Repair Shop uses the accrual

Q200: Super Clean operates an automatic car

Q201: Assuming the use of a work sheet,are

Q202: Describe the benefit(s)of using the accrual process

Q203: Explain the differences between the cash basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents