-Browning Cookware,Inc.has the following income statement items: sales of $50,250,000;operating expenses of $10,115,000;cost of goods sold of $35,025,000;and interest expense of $750,000.If the firm's income tax rate is 34%,what is the amount of the firm's income tax liability?

A) $1,665,000

B) $725,000

C) $385,000

D) $1,482,400

Correct Answer:

Verified

Q21: Corporate income statements are usually compiled on

Q31: Dividends paid to a firm's stockholders,both preferred

Q32: The income statement provides a statement of

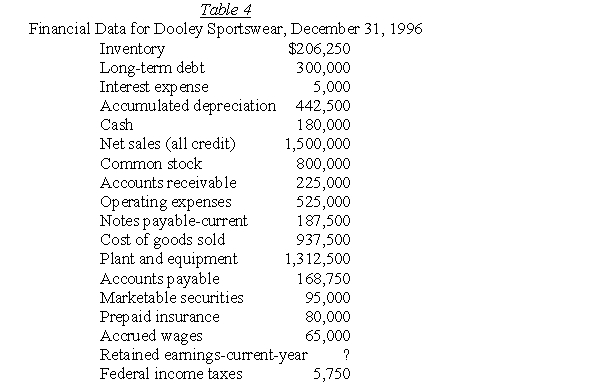

Q34: Use the following information to answer the

Q36: The marginal tax rate would equal the

Q37: Use the following information to answer the

Q38: The income statement represents a snapshot of

Q38: The income statement describes the financial position

Q48: The interest payments on corporate bonds are

Q59: Tax tables are based on _ tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents