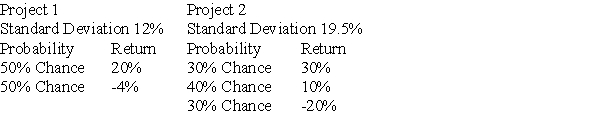

You are going to invest all of your funds in one of three projects with the following distribution of possible returns:

Project 3

Standard Deviation 12%

If you are a risk-averse investor,which one should you choose?

A) Project 1

B) Project 2

C) Project 3

Correct Answer:

Verified

Q65: The rate on six-month T-bills is currently

Q70: Betas for individual stocks tend to be

Q77: Bell Weather,Inc.has a beta of 1.25.The return

Q81: The rate of return on the S&P

Q82: The required rate of return for Firm

Q83: U.S.Treasury bonds currently yield 6%.Consolidated Industries stock

Q88: The market risk premium is measured by

A)

Q88: You are thinking about purchasing 1,000 shares

Q89: If investors expected inflation to increase in

Q90: What would happen if investors became more

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents