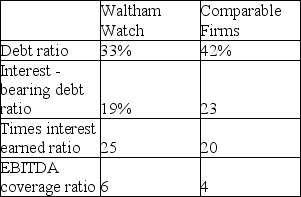

From the table above we can conclude:

A) Waltham has a conservative capital structure policies.

B) Waltham has too much debt.

C) Waltham uses more leverage than the typical firm in its industry.

D) Waltham's EPS would be more sensitive than a typical firm's to changes in EBIT.

Correct Answer:

Verified

Q61: Briefly explain what the empirical evidence suggests

Q64: Basic tools of capital structure management include:

A)EBIT-EPS

Q64: Which of the following factors favors the

Q67: Companies faced with higher tax burdens are

Q68: Which of the following is a good

Q70: The tax shield on interest is calculated

Q72: According to the pecking order theory of

Q82: When using an EPS-EBIT chart to evaluate

Q88: List and briefly explain at least two

Q89: Which two ratios would be most helpful

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents