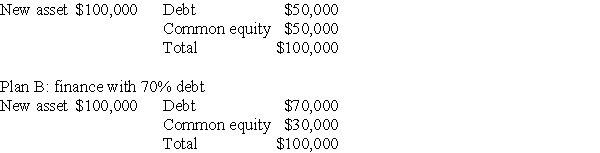

A firm is analyzing two different capital structures for financing a new asset that will cost $100,000.The effects of the two structures on the firm's balance sheet are described below.

Plan A: finance with 50% debt

Based on the information provided,we can conclude that:

A) if the firm chooses Plan A,then any changes in the firm's EBIT will lead to larger fluctuations in the firm's EPS than if the firm chooses Plan B.

B) if the firm chooses Plan B,then any changes in the firm's EBIT will lead to larger fluctuations in the firm's EPS than if the firm chooses Plan A.

C) if the firm chooses Plan A,then any changes in the firm's EBIT will lead to the same fluctuations in the firm's EPS as will occur if the firm chooses Plan B.

D) if the firm chooses Plan B,then any changes in the firm's EBIT will lead to smaller fluctuations in the firm's EPS than if the firm chooses Plan A.

Correct Answer:

Verified

Q78: U. S. companies differ very little in

Q80: Adams Inc. expects EBIT of $50 million

Q81: Lever Brothers has a debt ratio (debt

Q85: When benchmarking a firm's capital structure, management

Q85: Farar,Inc.projects operating income of $4 million next

Q86: As a general rule, the optimal capital

Q86: Lever Brothers has a debt ratio (debt

Q87: If a firm chose to increase its

Q103: The indifference level of EBIT is

A) $99,000.

B)

Q104: Useful ratios for benchmarking a firm's capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents