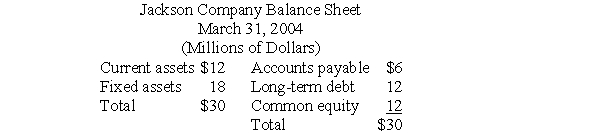

The balance sheet of the Jackson Company is presented below:

For the year ending March 31,2004,Jackson had sales of $35 million.The common stockholders received all net earnings of the firm in the form of cash dividends,leaving no funds from earnings available to the firm for expansion (assume that depreciation expense is just equal to the cost of replacing worn-out assets).

Construct a pro forma balance sheet for March 31,2005 for an expected level of sales of $45 million.Assume current assets and accounts payable vary as a percent of sales,and fixed assets remain at the present level.Use notes payable as a source of discretionary financing.

Correct Answer:

Verified

Q60: Considering each action independently and holding other

Q62: If the firm's current fixed assets are

Q63: Pro forma statements are important since they

Q64: What is meant by spontaneous financing?

Q66: Amalgamated Enterprises is planning to purchase some

Q69: Frog Hollow Bakery is a new firm

Q73: When fixed expenses increase relative to sales,

Q79: It is common practice to develop optimistic

Q79: Because accounts payable and accrued expenses increase

Q92: Which of the following is always a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents