40% of sales is collected in the month of the sale,50% is collected in the month following the sale,and 10% is written off as uncollectible.Cost of goods sold is 70% of sales.Purchases are made the month prior to the sale and are paid during the month the purchases are made (i.e.goods sold in March are bought and paid for in February) .Total other cash expenses are $50,000/month.The company's cash balance as of February 1,2004 will be $40,000.Excess cash will be used to retire short-term borrowing (if any) .Thompson has no short-term borrowing as of February 28,2004.Assume that the interest rate on short-term borrowing is 1% per month.The company must have a minimum cash balance of $25,000 at the beginning of each month.Round all answers to the nearest $100.

40% of sales is collected in the month of the sale,50% is collected in the month following the sale,and 10% is written off as uncollectible.Cost of goods sold is 70% of sales.Purchases are made the month prior to the sale and are paid during the month the purchases are made (i.e.goods sold in March are bought and paid for in February) .Total other cash expenses are $50,000/month.The company's cash balance as of February 1,2004 will be $40,000.Excess cash will be used to retire short-term borrowing (if any) .Thompson has no short-term borrowing as of February 28,2004.Assume that the interest rate on short-term borrowing is 1% per month.The company must have a minimum cash balance of $25,000 at the beginning of each month.Round all answers to the nearest $100.

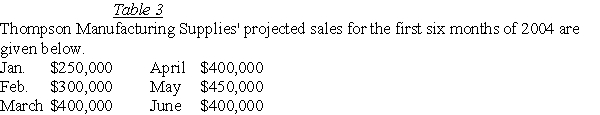

-Based on the information in Table 3,what is Thompson's projected cumulative borrowing as of March 1,2004?

A) $85,000

B) $45,000

C) $70,000

D) - 0 -

Correct Answer:

Verified