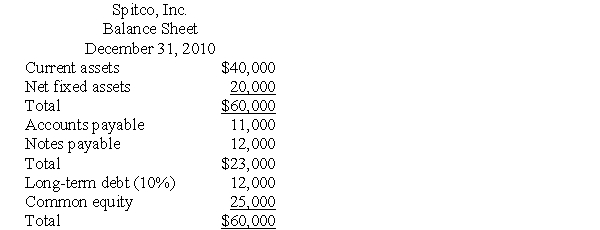

The December 31,1995 balance sheet for Spitco,Inc.is presented below.

a.Calculate Spitco's current ratio,and net working capital.

b.Spitco feels that its current ratio is too far below the industry average of 2.40.To improve their liquidity,the treasurer of Spitco has devised a plan to issue $12,000 in long-term debt at 12% and pay off its notes payable.The funds would be invested in marketable securities at 7% interest when not needed to finance the firm's seasonal asset needs.The notes payable would remain outstanding through the year.Assume this plan had been implemented for 2010.Calculate what the firm's current ratio,and net working capital would have been.

c.Did Spitco improve their liquidity? What do you think happened to Spitco's return on investment?

Correct Answer:

Verified

Q24: With respect to working capital policy, firms

Q25: Which of the following is most likely

Q29: Commercial paper

A) rates are generally higher than

Q30: Gamma,Inc.plans to sell $1 million in 270-day-maturity

Q30: Which of the following is most consistent

Q31: A toy manufacturer following the self-liquidating debt.principle

Q34: Which of the following is NOT considered

Q35: Spontaneous sources of financing include

A) marketable securities.

B)

Q37: With regard to the self-liquidating debt,which of

Q39: The balance sheet for Peterson Manufacturing Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents