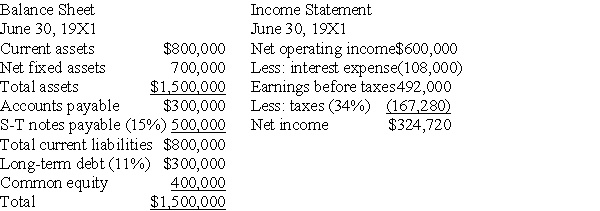

On June 30,19X1,the Alexander Bosh Coffee Co.'s balance sheet and income statement are as follows:

a.Calculate the current ratio and net working capital for Alexander Bosh.

b.Recalculate the ratios from (a)and assess the change in the firm's liquidity if the firm plans to issue $500,000 in common stock and use the proceeds to retire the firm's notes payable.

c.What effect would the change proposed in question b have on return on common equity (net income/common equity)?

Correct Answer:

Verified

Q3: Working capital refers to investment in current

Q5: Solstice Corporation has current assets of $10

Q8: Which of the following would be considered

Q9: Which of the following is most likely

Q20: Managing a firm's liquidity is basically the

Q21: Disadvantages of using current liabilities as opposed

Q26: Current assets of NorthPole.com at the end

Q28: Accounts payable is considered a

A) spontaneous liability.

B)

Q37: What is the conventional method for financing

Q40: Which of the following is considered to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents