Parent Corporation paid $105,000 to acquire 75% of the common shares of Subsidiary Inc.on December 31,2017.At that date,Parent Corporation also had an outstanding note payable to Subsidiary Inc.in the amount of $20,000.

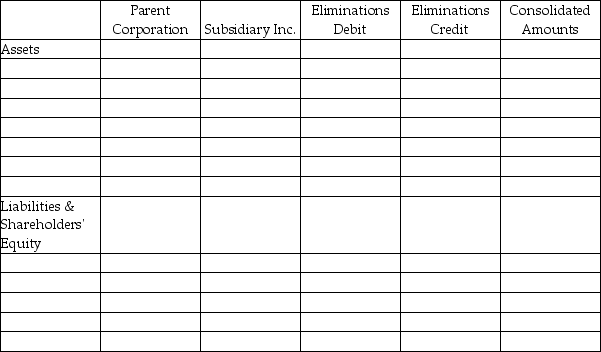

Assume that Parent Corporation and Subsidiary Inc.had the following account balances at December 31,2017 (immediately after the investment):

Liabilities and shareholders' equity:

Using the worksheet provided calculate the Consolidated Amounts for December 31,2017.

Correct Answer:

Verified

Q146: Long-term bond investments are reported on the

Q147: Suppose that $5,000 of 5% bonds were

Q148: The maximum amount received at the maturity

Q149: On December 31,2017,Parent Corporation paid $800,000

Q150: Table 16-11

Parent Corporation paid $110,000 to

Q152: Long-term investments in bonds are accounted for

Q153: Amortization of a premium on a bond

Q154: Table 16-11

Parent Corporation paid $110,000 to

Q155: Suppose $20,000 of 8% bonds were purchased

Q156: Investment in bonds is typically a long-term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents