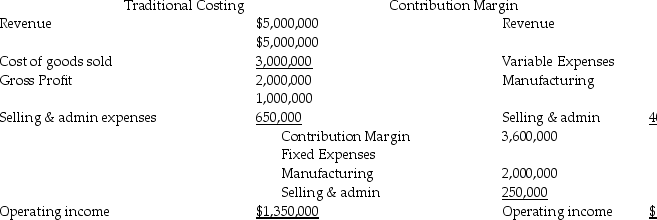

Sprint Company makes special equipment used in cell towers. Each unit sells for $400. Sprint produces and sells 12,500 units per year. They have provided the following income statement data:  A foreign company has offered to buy 80 units for a reduced price of $300 per unit. The marketing manager says the sale will not negatively affect the company's regular sales. The sales manager says that this sale will require incremental selling & administrative costs, as it is a one-time deal. The production manager reports that there is plenty of excess capacity to accommodate the deal without requiring any additional fixed costs. If Sprint accepts the deal, how will this impact operating income?

A foreign company has offered to buy 80 units for a reduced price of $300 per unit. The marketing manager says the sale will not negatively affect the company's regular sales. The sales manager says that this sale will require incremental selling & administrative costs, as it is a one-time deal. The production manager reports that there is plenty of excess capacity to accommodate the deal without requiring any additional fixed costs. If Sprint accepts the deal, how will this impact operating income?

A) up $15,040

B) down $15,040

C) up $24,000

D) down $24,000

Correct Answer:

Verified

Q21: Fantabulous Products sells 2,000 kayaks per year

Q33: Revenue at the market price less the

Q38: Gotham Products is a price-taker and

Q39: Rica Company is a price-taker and

Q41: Sprint Company makes special equipment used in

Q43: Centric Sail Makers manufacture sails for

Q44: Gabriel Metalworks produces a special kind

Q46: Sprint Company makes special equipment used in

Q54: Nelson Products is a price-setter, and they

Q60: Companies are price-takers when:

A)it is operating in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents