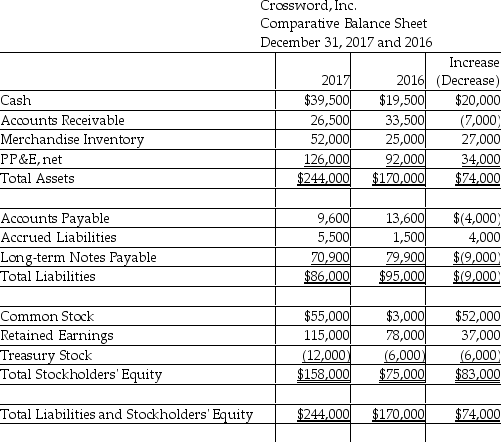

Crossword,Inc.uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2017:  Use the direct method to compute the payments to suppliers for Merchandise Inventory and other operating expenses.(Accrued Liabilities relate to other operating expense. )

Use the direct method to compute the payments to suppliers for Merchandise Inventory and other operating expenses.(Accrued Liabilities relate to other operating expense. )

A) $197,000

B) $177,500

C) $19,500

D) $201,000

Correct Answer:

Verified

Q123: What does free cash flow represent? How

Q125: Wellington,Inc.uses the direct method to prepare

Q127: Ocean Auto Parts Company uses the direct

Q128: Gitis,Inc.uses the direct method to prepare its

Q129: Davis Metals Company uses the direct method

Q131: Gladiator,Inc.uses the direct method to prepare its

Q132: Mei Company uses the direct method to

Q134: Martinez Installations Company uses the direct method

Q143: The direct method of reporting cash flows

Q151: The cash flow from investing activities section

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents