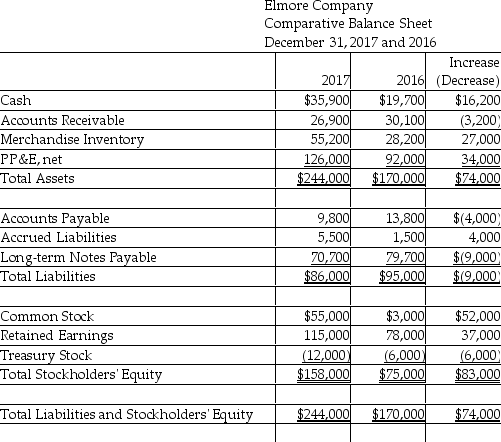

Elmore Company uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2017:

Use the direct method,to compute the total net cash flow from operating activities.(Accrued Liabilities relate to other operating expense. )

A) $(54,200)

B) $38,200

C) $(38,200)

D) $54,200

Correct Answer:

Verified

Q141: On a statement of cash flows prepared

Q142: Neutral Paints Company uses the direct

Q143: Merchandise Inventory increased $28,000 and Accounts Payable

Q146: Truesdell Brewery Company uses the direct

Q148: Jewel Tone Paints Company uses the

Q152: Bright Eyes Paints Company uses the

Q168: Which of the following is a cash

Q171: Which of the following appears on a

Q177: The spreadsheet starts with the beginning statement

Q180: The financing activities section of a statement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents