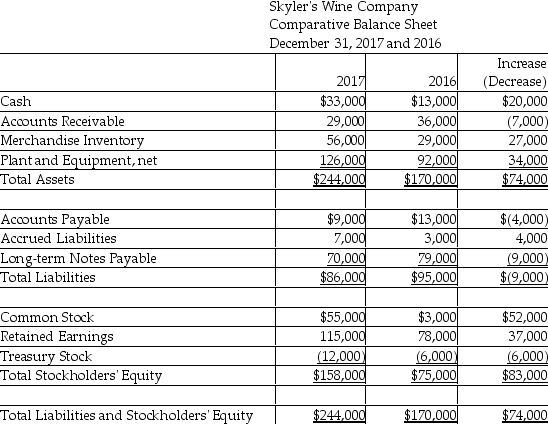

Skyler's Wine Company uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ending December 31,2017:

Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net asset value of $10,000 was sold for $16,000.

During 2017,the company repaid $43,000 of long-term notes payable.

During 2017,the company borrowed $34,000 on a new note payable.

There were no stock retirements during the year.

There were no sales of Treasury Stock during the year.

Prepare a complete statement of cash flows using the direct method.

Accrued Liabilities relate to other operating expenses.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q156: Colorful Cat Company uses the direct

Q159: The income statement and a partial

Q160: McDaniel,Inc.uses the direct method to prepare

Q161: Which of the following is considered an

Q162: The payment of interest on a loan

Q162: Regarding the use of a spreadsheet for

Q163: In practice,most companies face complex situations.In these

Q178: Which of the following items are included

Q179: Accountants can prepare the statement of cash

Q183: Regarding the use of a spreadsheet for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents