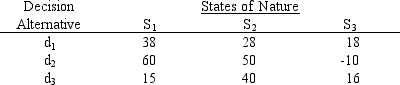

Suppose we are interested in investing in one of three investment opportunities: d1, d2, or d3. The following profit payoff table shows the profits (in thousands of dollars) under each of the 3 possible economic conditions-S1, S2, and S3:

Assume the states of nature have the following probabilities of occurrence: P(S1) = 0.2 P(S2) = 0.3 P(S3) = 0.5

a.Determine the expected value of each alternative and indicate which decision alternative is the best.

b.Determine the expected value with perfect information about the states of nature.

c.Determine the expected value of perfect information.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: When working backward through a decision tree,

Q50: An investor has a choice between four

Q51: A fashion designer wants to produce a

Q53: Below you are given a payoff table

Q54: You are given the following payoff table:

Q55: Application of Bayes' theorem enables us to

Q56: An automobile manufacturer must make an immediate

Q57: A sequence of decisions and chance outcomes

Q59: Suppose we are interested in investing in

Q60: A posterior probability associated with sample information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents