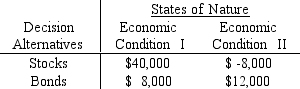

Assume you have a sum of money available which you would like to invest in one of the two available investment plans: Stocks or bonds. The conditional payoffs of each plan under two possible economic conditions are as follows:

a.If the probability of Economic Condition I occurring is 0.8, where should you invest your money? Use the expected value criterion and show your complete work.

b.Compute the expected value of perfect information (EVPI).

c.What kind of probabilities of Economic Conditions I and II should there be before you would be indifferent between investing in stocks and bonds? (i.e., compute the probabilities for which you will be indifferent between investing in stocks or bonds.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: Application of Bayes' theorem enables us to

Q56: An automobile manufacturer must make an immediate

Q57: A sequence of decisions and chance outcomes

Q59: Suppose we are interested in investing in

Q60: A posterior probability associated with sample information

Q62: A maintenance department replaces a malfunctioning machine

Q63: You are given a decision situation with

Q64: Consider the following profit payoff table.

Q65: An automobile manufacturer stocks an electric motor

Q66: Michael, Nancy, & Associates (MNA) produce color

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents