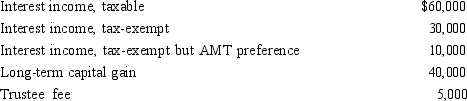

The Kapoor Trust is your client. Complete the chart below, indicating Kapoor's trust accounting income for each of

the alternatives.

Trust agreement provisions Trust accounting income

Trust agreement provisions Trust accounting income

Fees and capital gains allocable to corpus ______________________

Capital gains allocable to corpus, one-half of fees

allocable to income ______________________

Capital gains allocable to income, silent

concerning allocation of fees ______________________

Fees and exempt income allocable to corpus,

silent concerning allocation of capital gain/loss ______________________

Correct Answer:

Verified

Q117: If the grantor can receive borrowed funds

Q128: Summarize the Federal income tax rules that

Q129: The Gomez Trust is required to distribute

Q132: The Federal income taxation of a trust

Q135: List at least three non-tax reasons that

Q137: The trustee of the Miguel Trust can

Q140: Reggie is one of the income beneficiaries

Q145: When the Holloway Trust terminated this year,

Q148: The Circle Trust reports some exempt interest

Q149: The Gibson Estate is responsible for collecting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents