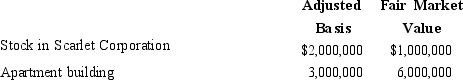

Liam and Isla are husband and wife and have always lived in a community property state. At the time of Isla's prior death, part of their community property includes: Under Isla's will, all of her property passes to Liam. After Isla's death, Liam's income tax basis in this property is:

Under Isla's will, all of her property passes to Liam. After Isla's death, Liam's income tax basis in this property is:

A) $2,500,000.

B) $3,500,000.

C) $7,000,000.

D) $8,000,000.

E) None of the above.

Correct Answer:

Verified

Q83: If the special use valuation method of

Q90: Chloe makes a gift of stock in

Q91: After a prolonged illness, Avery has been

Q94: In April 2013, Tim makes a gift

Q95: Paul dies and leaves his traditional IRA

Q96: At the time of his death, Al

Q97: In 2005, Gloria purchased as an investment

Q97: Which, if any, of the following items

Q100: When the annual exclusion was $14,000, Arlene

Q116: Wesley has created an irrevocable trust: life

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents