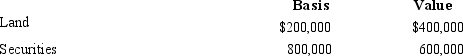

Curt owns the following assets which he gives to his daughter Carla. No gift tax results. Fair Market Both items have been held by Curt as an investment for more than one year. If Carla immediately sells these assets for $1 million ($400,000 + $600,000) , she recognizes:

Both items have been held by Curt as an investment for more than one year. If Carla immediately sells these assets for $1 million ($400,000 + $600,000) , she recognizes:

A) No gain or loss.

B) A $200,000 LTCG and no loss.

C) A $200,000 STCG and $200,000 STCL.

D) A $200,000 STCG and no loss.

E) A $200,000 LTCG and $200,000 LTCL.

Correct Answer:

Verified

Q68: Which, if any, of the following statements

Q70: To prove successful in freezing the value

Q78: In 2014, Donna's father dies and leaves

Q80: Which, if any, of the following procedures

Q82: In 1990, Mia, a resident of New

Q84: Lisa has been widowed three times. Her

Q85: In January 2013 and when the annual

Q85: For purposes of § 6166 (i.e., extension

Q89: When the annual exclusion was $14,000, Pam

Q90: Which of the following procedures carried out

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents