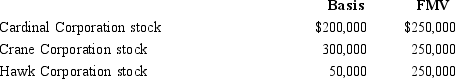

Eric, age 80, has accumulated about $6 million in net assets. Among his assets are the following marketable securities held as investments.  Eric would like to donate (either by lifetime or testamentary transfer) $250,000 in value to his church. In addition, to consummate a land deal, he needs $250,000 in cash. Looking solely to tax: considerations and using only the assets described above, Eric's best choice is to:

Eric would like to donate (either by lifetime or testamentary transfer) $250,000 in value to his church. In addition, to consummate a land deal, he needs $250,000 in cash. Looking solely to tax: considerations and using only the assets described above, Eric's best choice is to:

A) Donate by gift to the church the Crane stock and sell the Hawk stock now.

B) Donate by death to the church the Hawk stock and sell the Cardinal stock now.

C) Donate by gift to the church the Hawk stock and sell the Crane stock now.

D) Donate by gift to the church the Cardinal stock and sell the Hawk stock now.

E) None of the above is an attractive technique.

Correct Answer:

Verified

Q79: The election of § 2032 (alternate valuation

Q85: For purposes of § 6166 (i.e., extension

Q89: In 1990, Jude, a resident of New

Q89: When the annual exclusion was $14,000, Pam

Q90: Chloe makes a gift of stock in

Q91: In 2011, Sophia sold real estate (adjusted

Q94: In April 2013, Tim makes a gift

Q95: Paul dies and leaves his traditional IRA

Q97: Which, if any, of the following items

Q97: In 2005, Gloria purchased as an investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents