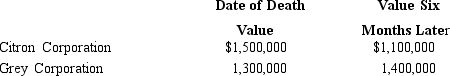

At the time of his death, Tom owned some common stock.  The Citron Corporation stock is sold by the executor of the estate seven months after Tom's death for $1,300,000. If the alternate valuation date is properly elected, the value of Tom's estate as to these stocks is:

The Citron Corporation stock is sold by the executor of the estate seven months after Tom's death for $1,300,000. If the alternate valuation date is properly elected, the value of Tom's estate as to these stocks is:

A) $2,300,000.

B) $2,400,000.

C) $2,500,000.

D) $2,700,000.

E) None of the above.

Correct Answer:

Verified

Q65: A marital deduction is not allowed if

Q84: The current top Federal transfer tax rate

Q84: The U.S.has death tax conventions (i.e. ,treaties)

Q86: Eric dies at age 96 and is

Q88: In which, if any, of the following

Q89: Which, if any, of the following is

Q91: In which, if any, of the following

Q94: In which of the following situations is

Q95: In which, if any, of the following

Q99: In determining the Federal gift tax on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents