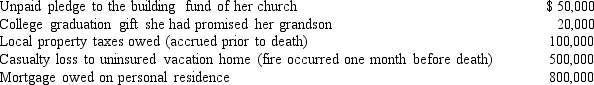

At the time of her death, Amber owns property worth $5,000,000. Other information regarding her affairs is as follows.

All of these items (except the casualty loss) were paid by her estate, and none were deducted on Form 1041 (income tax return of the estate). What is Amber's taxable estate?

All of these items (except the casualty loss) were paid by her estate, and none were deducted on Form 1041 (income tax return of the estate). What is Amber's taxable estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: In which of the following situations has

Q118: Pursuant to Corey's will,Emma (Corey's sister) inherits

Q120: At the time of her death on

Q121: Homer and Laura are husband and wife.

Q122: At the time of her death, Sophia

Q123: Gerald and Pat are husband and wife

Q125: Murray owns an insurance policy on the

Q126: In 1992, Daniel and Mia acquire realty

Q127: In 1985, Drew creates a trust with

Q143: At the time of Clint's death, part

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents