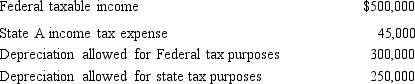

Ramirez Corporation is subject to tax only in State A. Ramirez generated the following income and deductions.  Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Ramirez's A taxable income is:

Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Ramirez's A taxable income is:

A) $495,000.

B) $500,000.

C) $545,000.

D) $595,000.

Correct Answer:

Verified

Q26: S corporations flow through income amounts to

Q33: Typically exempt from the sales/use tax base

Q37: A taxpayer has nexus with a state

Q39: The use tax is designed to complement

Q40: The property factor includes land and buildings

Q43: Zhao Company sold an asset on the

Q44: The model law relating to the assignment

Q45: Marquardt Corporation realized $900,000 taxable income from

Q50: Flint Corporation is subject to a corporate

Q52: Sales/use tax nexus is established for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents