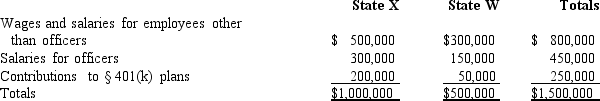

Net Corporation's sales office and manufacturing plant are located in State X. Net also maintains a manufacturing plant and sales office in State W. For purposes of apportionment, X defines payroll as all compensation paid to employees, including contributions to § 401(k) deferred compensation plans. Under the statutes of W, neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor. Net incurred the following personnel costs.  Net's payroll factor for State W is:

Net's payroll factor for State W is:

A) 50.00%.

B) 37.50%.

C) 33.33%.

D) 0.00%.

Correct Answer:

Verified

Q64: General Corporation is taxable in a number

Q67: Guilford Corporation is subject to franchise tax

Q68: General Corporation is taxable in a number

Q70: Cruz Corporation owns manufacturing facilities in States

Q74: Given the following transactions for the year,

Q75: Boot Corporation is subject to income tax

Q76: General Corporation is taxable in a number

Q76: Chipper Corporation realized $1,000,000 taxable income from

Q78: The throwback rule requires that:

A)Sales of tangible

Q82: In the broadest application of the unitary

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents