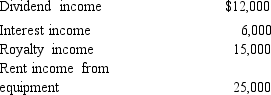

City, Inc., an exempt organization, has included among other amounts the following in calculating net unrelated business income of $500,000.

The only expenses incurred associated with these items are rental expenses (which includes depreciation of $10,000) of $15,000. Calculate City, Inc.'s UBTI.

The only expenses incurred associated with these items are rental expenses (which includes depreciation of $10,000) of $15,000. Calculate City, Inc.'s UBTI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Faith Church,a § 501(c)(3) organization,operates a bingo

Q67: The Dispensary is a pharmacy that is

Q112: What are the common characteristics of organizations

Q116: Amber, Inc., an exempt organization, reports unrelated

Q117: An exempt organization owns a building for

Q117: How can an exempt organization otherwise classified

Q122: Loyal, Inc., is a §501(c)(3) organization that

Q123: Which requirements must be satisfied for an

Q127: Plus, Inc., is a § 501(c)(3) organization.It

Q138: Describe how an exempt organization can be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents