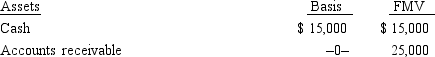

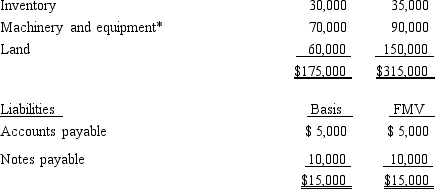

Ralph owns all the stock of Silver, Inc., a C corporation for which his adjusted basis is $225,000. Ralph founded Silver 12 years ago. The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Ralph has agreed to sell the business to Marilyn and they have agreed on a purchase price of $350,000 less any outstanding liabilities. They are both in the 35% tax bracket, and Silver is in the 34% tax bracket.

a. Advise Ralph on whether the form of the sales transaction should be a stock sale or an asset sale.

b. Advise Marilyn on whether the form of the purchase transaction should be a stock purchases or an asset purchase.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Meg has an adjusted basis of $150,000

Q93: List some techniques for reducing and/or avoiding

Q94: Swallow, Inc., is going to make a

Q106: Eagle, Inc. recognizes that it may have

Q112: What is the major pitfall associated with

Q113: Lee owns all the stock of Vireo,

Q114: Lisa is considering investing $60,000 in a

Q115: Included among the factors that influence the

Q115: Melanie and Sonny form Bird Enterprises. Sonny

Q116: Which of the following business entity forms

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents