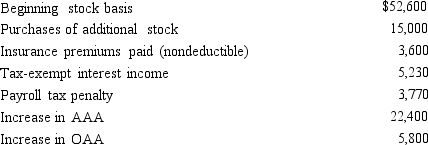

You are a 60% owner of an S corporation. Calculate your ending stock basis, based upon these facts.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q113: Discuss two ways that an S election

Q117: Advise your client how income, expenses, gain,

Q120: An S corporation's separately stated items generally

Q140: Tax-exempt income is listed on Schedule _

Q141: On December 31, 2014, Erica Sumners owns

Q141: Individuals Adam and Bonnie form an S

Q143: Alomar, a cash basis S corporation in

Q147: Chris, the sole shareholder of Taylor, Inc.,

Q149: Match the term with the proper response.

Q155: Discuss the two methods of allocating tax-related

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents