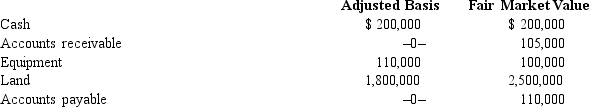

Alomar, a cash basis S corporation in Orlando, Florida, holds the following assets and liabilities on January 1, 2014, the date the S election is made.

During 2014, Alomar collects the accounts receivable and pays the accounts payable. The land is sold for $3 million, and the taxable income for the year is $590,000. Calculate any built-in gains tax.

During 2014, Alomar collects the accounts receivable and pays the accounts payable. The land is sold for $3 million, and the taxable income for the year is $590,000. Calculate any built-in gains tax.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q113: Discuss two ways that an S election

Q117: Advise your client how income, expenses, gain,

Q120: An S corporation's separately stated items generally

Q126: Since loss property receives a _ in

Q140: Tax-exempt income is listed on Schedule _

Q141: On December 31, 2014, Erica Sumners owns

Q141: Individuals Adam and Bonnie form an S

Q144: You are a 60% owner of an

Q147: Chris, the sole shareholder of Taylor, Inc.,

Q155: Discuss the two methods of allocating tax-related

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents