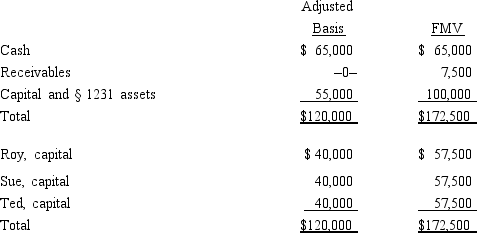

The December 31, 2014, balance sheet of the RST General Partnership reads as follows.  The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2014, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2014, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

A) If capital is NOT a material incomeproducing factor to the partnership, the § 736(a) payment will be $2,500.

B) If capital IS a material incomeproducing factor, the entire $60,000 payment will be a § 736(b) property payment.

C) The payment for Ted's share of goodwill will create $2,500 of ordinary income to him.

D) The partnership can deduct any amount that is a § 736(a) payment because it will be determined without regard to partnership profits.

E) All statements are false.

Correct Answer:

Verified

Q66: Last year, Darby contributed land (basis of

Q74: In a proportionate liquidating distribution, Ashleigh receives

Q78: Brittany, Jennifer, and Daniel are equal partners

Q100: Which of the following statements, if any,

Q104: Match the following statements with the best

Q109: Match the following statements with the best

Q118: Match the following statements with the best

Q132: Nicholas is a 25% owner in the

Q149: Which of the following statements correctly reflects

Q173: Match each of the following statements with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents