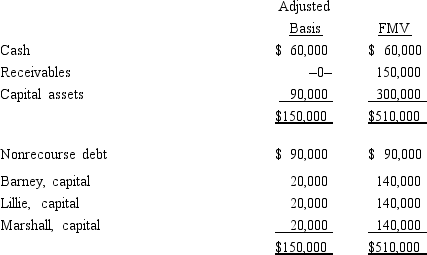

The BLM LLC's balance sheet on August 31 of the current year is as follows.  The nonrecourse debt is shared equally among the LLC members. On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt. Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt. How much capital gain and/or ordinary income will Lillie recognize on the sale?

The nonrecourse debt is shared equally among the LLC members. On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt. Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt. How much capital gain and/or ordinary income will Lillie recognize on the sale?

A) $100,000 capital gain; $50,000 ordinary income.

B) $120,000 capital gain; $0 ordinary income.

C) $150,000 capital gain; $0 ordinary income.

D) $70,000 capital gain; $50,000 ordinary income.

E) None of the above.

Correct Answer:

Verified

Q64: The RST Partnership makes a proportionate distribution

Q74: Cynthia sells her 1/3 interest in the

Q74: In a proportionate liquidating distribution, Ashleigh receives

Q75: Which of the following is not typically

Q76: Which of the following distributions would never

Q80: Which of the following statements about the

Q135: Which of the following statements is true

Q149: Which of the following statements correctly reflects

Q150: In a proportionate liquidating distribution, Sam receives

Q222: In a proportionate liquidating distribution, Sara receives

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents