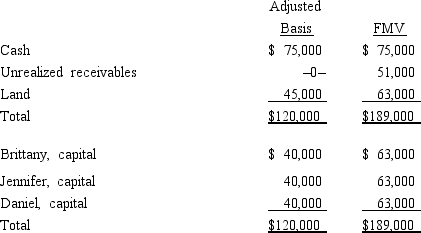

Brittany, Jennifer, and Daniel are equal partners in the BJD Partnership. The partnership balance sheet reads as follows on December 31 of the current year.  Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

A) $6,000

B) $17,000

C) $23,000

D) $33,000

E) None of the above

Correct Answer:

Verified

Q66: Last year, Darby contributed land (basis of

Q74: In a proportionate liquidating distribution, Ashleigh receives

Q74: Cynthia sells her 1/3 interest in the

Q80: The December 31, 2014, balance sheet of

Q104: Match the following statements with the best

Q109: Match the following statements with the best

Q132: Nicholas is a 25% owner in the

Q135: Which of the following statements is true

Q149: Which of the following statements correctly reflects

Q173: Match each of the following statements with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents