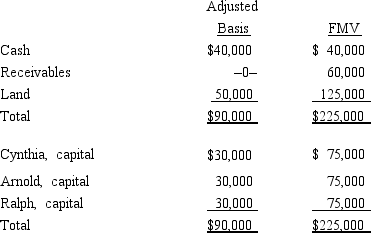

Cynthia sells her 1/3 interest in the CAR Partnership to Brandon for $95,000 cash. On the date of sale, the partnership balance sheet and agreed-upon fair market values were as follows:  If the partnership has a § 754 election in effect, the total "stepup" in basis of partnership assets that will be allocated to Brandon is:

If the partnership has a § 754 election in effect, the total "stepup" in basis of partnership assets that will be allocated to Brandon is:

A) $75,000.

B) $65,000.

C) $45,000.

D) $20,000.

E) $0.

Correct Answer:

Verified

Q64: The RST Partnership makes a proportionate distribution

Q66: Last year, Darby contributed land (basis of

Q71: The BLM LLC's balance sheet on August

Q74: In a proportionate liquidating distribution, Ashleigh receives

Q75: Which of the following is not typically

Q78: Brittany, Jennifer, and Daniel are equal partners

Q132: Nicholas is a 25% owner in the

Q135: Which of the following statements is true

Q149: Which of the following statements correctly reflects

Q222: In a proportionate liquidating distribution, Sara receives

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents