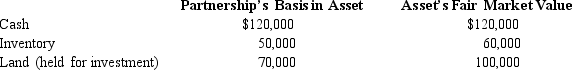

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $200,000. On that date, she receives a proportionate nonliquidating distribution of the following assets:

a. Calculate Karli's recognized gain or loss on the distribution, if any.

b. Calculate Karli's basis in the inventory received.

c. Calculate Karli's basis in land received. The land is a capital asset.

d. Calculate Karli's basis for her partnership interest after the distribution.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Match the following statements with the best

Q118: Match the following independent distribution payments in

Q121: The December 31, 2014, balance sheet of

Q122: Your client, Greg, transferred precontribution gain property

Q125: Randy owns a one-fourth capital and profits

Q126: Match the following statements with the best

Q127: On August 31 of the current tax

Q128: The December 31, 2014, balance sheet of

Q144: Serena owns a 40% interest in the

Q191: In a proportionate liquidating distribution in which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents