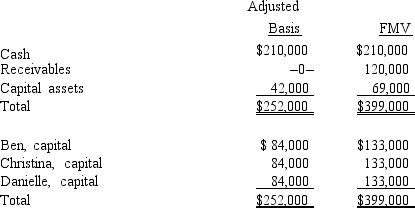

The December 31, 2014, balance sheet of the BCD LLP reads as follows.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2014, general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2014, general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

How much is Christina's recognized gain from the distribution and what is the character of the gain?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: Jeremy is an active partner who owns

Q125: Randy owns a one-fourth capital and profits

Q127: On August 31 of the current tax

Q128: The December 31, 2014, balance sheet of

Q131: Josh has a 25% capital and profits

Q144: Serena owns a 40% interest in the

Q152: Match the following independent descriptions as hot

Q186: In a proportionate nonliquidating distribution of his

Q191: In a proportionate liquidating distribution in which

Q232: In a proportionate liquidating distribution in which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents