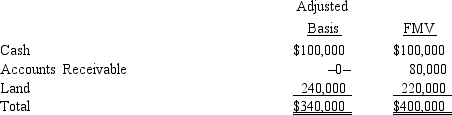

Hannah sells her 25% interest in the HIJK Partnership to Alyssa for $120,000 cash. At the end of the year prior to the sale, Hannah's basis in HIJK was $70,000. The partnership allocates $15,000 of income to Hannah for the portion of the year she was a partner. On the date of the sale, the partnership assets and the agreed fair market values were as follows.

Determine the amount and character of any gain that Hannah recognizes on the sale.

Determine the amount and character of any gain that Hannah recognizes on the sale.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: Cindy, a 20% general partner in the

Q131: Compare the different tax results (gains, losses,

Q132: George (a calendar year taxpayer) owns a

Q136: Connie owns a one-third capital and profits

Q143: Your client has operated a sole proprietorship

Q150: Melissa is a partner in a continuing

Q152: Match the following independent descriptions as hot

Q155: Julie is an active owner of a

Q223: In a proportionate liquidating distribution of his

Q224: Susan is a one-fourth limited partner in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents