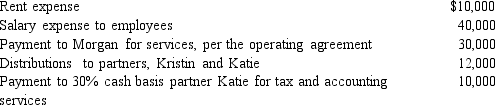

Morgan is a 50% managing member in the calendar year, cash basis MKK LLC. The LLC received $150,000 income from services and paid the following other amounts:

How much will Morgan's adjusted gross income increase as a result of the above items? What amount will be included in Morgan's selfemployment tax calculation?

How much will Morgan's adjusted gross income increase as a result of the above items? What amount will be included in Morgan's selfemployment tax calculation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Ryan is a 25% partner in the

Q84: An examination of the RB Partnership's tax

Q84: In the current year,the DOE LLC received

Q88: The MOP Partnership is involved in construction

Q146: George and James are forming the GJ

Q167: In the current year, Derek formed an

Q170: Jeordie and Kendis created the JK Partnership

Q183: Sarah contributed fully depreciated ($0 basis) property

Q204: Sharon and Sue are equal partners in

Q221: On the formation of a partnership, when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents