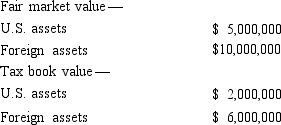

Qwan, a U.S. corporation, reports $250,000 interest expense for the tax year. None of the interest relates to nonrecourse debt or loans from affiliated corporations. Qwan's U.S. and foreign assets are reported as follows.  How should Qwan assign its interest expense between U.S. and foreign sources to maximize its FTC for the current year?

How should Qwan assign its interest expense between U.S. and foreign sources to maximize its FTC for the current year?

A) Using tax book values.

B) Using tax book value for U.S. source and fair market value for foreign source.

C) Using fair market values.

D) Using fair market value for U.S. source and tax book value for foreign source.

Correct Answer:

Verified

Q21: U.S. income tax treaties typically:

A) Provide for

Q23: The purpose of the transfer pricing rules

Q25: Nico lives in California. She was born

Q27: Gains on the sale of U.S. real

Q33: An appropriate transfer price is one that

Q38: ForCo, a subsidiary of a U.S. corporation

Q43: The U.S.system for taxing income earned outside

Q47: Which of the following statements is false

Q53: Section 482 is used by the Treasury

Q59: Olaf, a citizen of Norway with no

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents