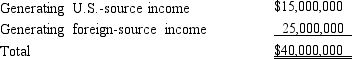

Goolsbee, Inc., a U.S. corporation, generates U.S.source and foreignsource gross income. Goolsbee's assets (tax book value) are as follows.

Goolsbee incurs interest expense of $200,000. Using the asset method and the tax book value, apportion interest expense to foreign-source income.

Goolsbee incurs interest expense of $200,000. Using the asset method and the tax book value, apportion interest expense to foreign-source income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Which of the following statements regarding the

Q93: RainCo, a U.S. corporation, owns a number

Q100: GlobalCo, a foreign corporation not engaged in

Q104: Which of the following statements is true,concerning

Q105: Match the definition with the correct term.

-Method

Q106: AirCo,a domestic corporation,purchases inventory for resale from

Q119: Match the definition with the correct term.

-Treasury

Q121: Given the following information,determine if FanCo,a foreign

Q123: With respect to income generated by non-U.S.

Q125: The § 367 cross-border transfer rules seem

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents