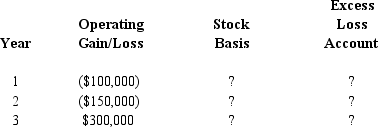

Calendar year Parent Corporation acquired all of the stock of SubCo on January 1, Year 1, for $500,000. The subsidiary's operating gains and losses are shown below. In addition, a $50,000 dividend is paid early in Year 2.

Complete the following chart, indicating the appropriate stock basis and excess loss account amounts.

Correct Answer:

Verified

Q87: Dividends paid out of a subsidiary's E

Q89: In computing consolidated taxable income, the profit/loss

Q95: If there is a balance in the

Q97: In computing consolidated taxable income, a net

Q105: In the year that the group terminates

Q114: The Parent consolidated group reports the following

Q115: The Parent consolidated group reports the following

Q120: When both apply, the § 382 NOL

Q121: For each of the indicated tax years,

Q131: How many consolidated tax returns are filed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents