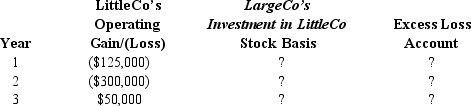

LargeCo files on a consolidated basis with LittleCo. The subsidiary was acquired for $400,000 on January 1, Year 1, and it paid a $75,000 dividend to LargeCo at the end of both Year 2 and Year 3.

a. Given the following information about the subsidiary's operating results, derive the requested amounts as of December 31 of each year. The group files using a calendar year.

b. LargeCo sold LittleCo to an unrelated competitor for $600,000 on December 31, Year 3. How will LargeCo account for this sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: In computing consolidated taxable income, the purchase

Q88: When negative adjustments are made to the

Q91: The rules can limit the net operating

Q98: The consolidated return rules combine the members'

Q103: The domestic production activities deduction (DPAD) of

Q104: TopCo owns all of the stock of

Q109: The treatment of group items on a

Q109: Maxi Corporation owns 100% of the stock

Q110: If one member sells an asset with

Q113: ParentCo's controlled group includes the following members.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents